What Budget 2023 Means for Your Business

On February 28, the Government of British Columbia released its 2023 budget and fiscal plan, StrongerBC for everyone. Building on its previous commitments, Budget 2023 proposes a range of measures focused on areas related to public healthcare, mental health and addictions care, housing affordability and affordability for B.C. families, public safety, and attracting and retaining labour to B.C. through the Future Ready plan.

The Budget unfortunately does not contain any significant or meaningful measures to alleviate the cost of doing business, generate investment or promote long term competitiveness for B.C. It is concerning that this budget focuses so much on spending and pays little attention to driving investment and the infrastructure needed to grow the economy. While the current year ending March 31 projects a surplus of $3.6 billion, the Premier and Cabinet have made clear that more spending may be on the way as the Budget returns to deficit spending of $4.2 billion for 2023-24. It is likely that within a week or two of the Budget being tabled, the current year fiscal projects will be out of date.

In response to the Budget, the Greater Vancouver Board of Trade released a statement, grading the Budget an overall 'C-' in terms of economic vision, fiscal prudence and tax competitiveness. GVBOT has also released a longer budget analysis document, which can be downloaded here.

This document provides an overview of ten initiatives from Budget 2023 that the Greater Vancouver business community should have on their radar.

10 Things You Need to Know About Budget 2023

1. Lack of Measures to Address Cost of Doing Business

A big concern for the business community is the lack of initiatives to address the soaring cost of doing business, with no significant tax breaks[1] for B.C. businesses. At a time when businesses are still overcoming pandemic-related challenges, and coping with inflation, the rising cost of inputs and supply chain disruptions, these measures are much needed yet noticeably absent from the Budget.

Notably, B.C.'s Carbon Tax will increase annually by $15 per tonne until rates are equal to $170 in 2030. The $15 increase in the carbon tax will cost $584 million in 2023-24 and $780 million the 2024-25 for a total of $1.3 billion. To offset those increased revenues, the government has increased the climate action tax credit and other measure for a total of $412 million and $549 million in 2024-25. However, the government appears to be retaining a total of $406 million from carbon tax revenues over two years towards general government revenues.

2. Lack of Measures to Spur Competitiveness and Prosperity

Similarly, the Budget lacks a long-term financial vision for the province. Budget 2023 makes no mention of further investments in the StrongerBC plan released in 2022. While uncertainty regarding a possible recession remains, B.C. should be thinking long term and making sure we have a plan to be in good financial health for the years to come.

3. Public Safety Investments to Help Businesses and Communities

The business community has been asking the province to do its part to address the public safety challenges that have worsened in recent years, especially in urban downtown areas. The Budget proposes measures to improve the safety of B.C. communities, including $317 million for policing and enforcement programs, committing to modernizing the Police Act and creating a Provincial Encampment Response Framework. We do support a coordinated response to encampments as well as the multifaceted changes on Vancouver's downtown east side. The details of what the funds would be spent on remain to be seen, with a suggestion that a good portion of funding may go to services for rural, remote and Indigenous services.

4. Healthcare Investments Are Strong

Predictably, the Budget increased investments in healthcare by a substantive $3 billion in one year. The government is betting that sizable investments today will result in improved outcomes for British Columbians families. While there are significant investments in healthcare, further investments in health innovation and life sciences would be most welcome.

5. Funding To Tackle Acute Labour and Skills Challenges

Budget 2023 includes promising investment responding to acute labour challenges and recommendations made in the Board of Trade's recently released report - Solving B.C.'s Workforce Challenges. For example, the B.C. Government is investing $58 million over three years to expand supports for newcomers and speed up foreign credential recognitions for qualified professionals. New investments in the foreign credential recognition program will help improve standards, such as processing timelines, for all B.C. professional regulators to help reduce barriers to newcomers entering their field.

We are also pleased to see the government invest $480 million to support the Future Ready Plan which was developed to help train and attract talent in B.C., including $39 million over three years for a new short-term skills training grant. The Budget noted that the Future Ready Plan will include mechanisms and funding to help small and medium-sized businesses in responding to current labour challenges. We look forward to reviewing the plan in detail when it is released in the coming months.

6. More Provincial Housing Dollars but Fewer Overall Units

The Budget allocates new operating and capital funding to build more homes, and other investments in housing, although a full housing plan is expected in the coming months from Housing Minister Ravi Kahlon. However, at the same time, the Budget projects that the number of housing starts will decline by roughly 8,000 units this year compared to last year. This shows how important market-based housing delivery is to overall supply. The Budget did seek to address issues with the double taxation of property transfer taxes for rentals.

7. Growing Public Sector Employment and Expenses

Public-sector job growth in B.C. has been increasing at a rapid pace, which continues with Budget 2023. Currently, the B.C. public sector employs 500,182 people, with a majority (45%) of staff working in health. According to the provincial government, government and provincial public-sector employers spend nearly $38.6 billion on compensation, equivalent to more than half of the Province's budget.

With a lack of investments to spur private-sector growth, the province risks becoming too reliant on public-sector growth long term.

Budget 2023 includes a new Shared Recovery Mandate that applies to all public-sector employers with unionized employees whose collective agreements expire on or after December 31, 2021. Negotiations are focused on providing a fair and reasonable offer to public-sector workers that includes significant inflation protection. According to the provincial government, about 290,000 provincial public-sector employees are covered by tentative or ratified agreements reached under B.C.'s Shared Recovery Mandate.

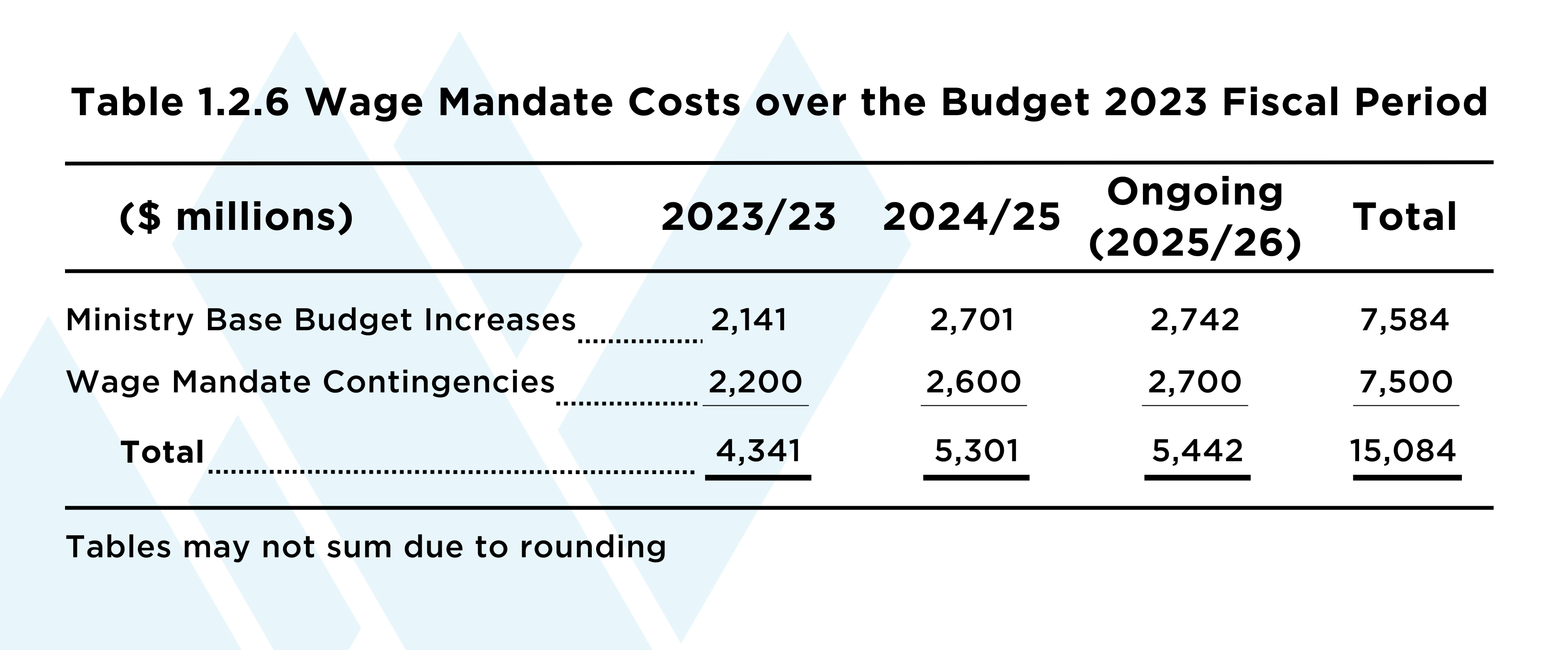

Budget 2023 states that the 2022 Shared Recovery Mandate is estimated to cost $10.8 billion over the three-year mandate term (2022/23 to 2024/25), with an annual ongoing cost of $5.4 billion.

Source: Budget and Fiscal Plan 2023/24 to 2025/26, p.26

8. Several Affordability Measures for Families

The Budget includes some measures for overall affordability for British Columbians including making prescription contraception free starting April 1, 2023, expanding K-12 school food programs, increasing student financial aid allowances and increasing financial supports for foster families.

9. Further Action on Climate Resiliency and Emergency Response

The 2021 extreme weather events highlighted the need for major infrastructure investments in dikes, fire suppression and other adaptation measures to increase B.C.'s resilience. The Budget outlines several climate change and emergency preparedness initiatives supported by over $1 billion, including $40 million more for the CleanBC Go Electric Vehicle Pilots Program which supports businesses to switch to ZEV.

10. Fiscal & Economic Outlook

Some quick numbers and trends:

- Economic growth: 0.4% real GDP growth in 2023 – suggests avoiding a significant recession but points towards anemic near-term growth.

- Revenue: Total revenue is expected to decline 6% in 2023/24, followed by an increase of 2.6% in 2024/26 and 3.1% in 2025/26.

- Employer health tax: $2.7 billion in 2023/24 (Expected to grow on average 4.8% annually)

- Contingency: Compared to contingencies allocated in pre-pandemic, the amount reserved for unforeseen and unbudgeted costs that may arise substantially increased from $750 million in 2019/20 to $5.5 billion in 2023/24.

- Debt: Debt-to-GDP supported by taxpayers is expected to be on the rise. Total provincial debt is projected to increase by $40.8 billion over the fiscal plan period to $134.3 billion by 2025/26.

References

[1] Budget 2023 does include a point-of-sale reduced tax for greenhouse growers for purchases of natural gas and propane used for operations

Links

- Greater Vancouver Board of Trade Budget 2023 Report Card

- Greater Vancouver Board of Trade Budget 2023 Analysis

- Solving B.C.'s Workforce Challenges

- PSEC Provincial Bargaining Update - March 08, 2023

- Budget and Fiscal Plan (2023/24 – 2025/26)